Unparalleled Potential

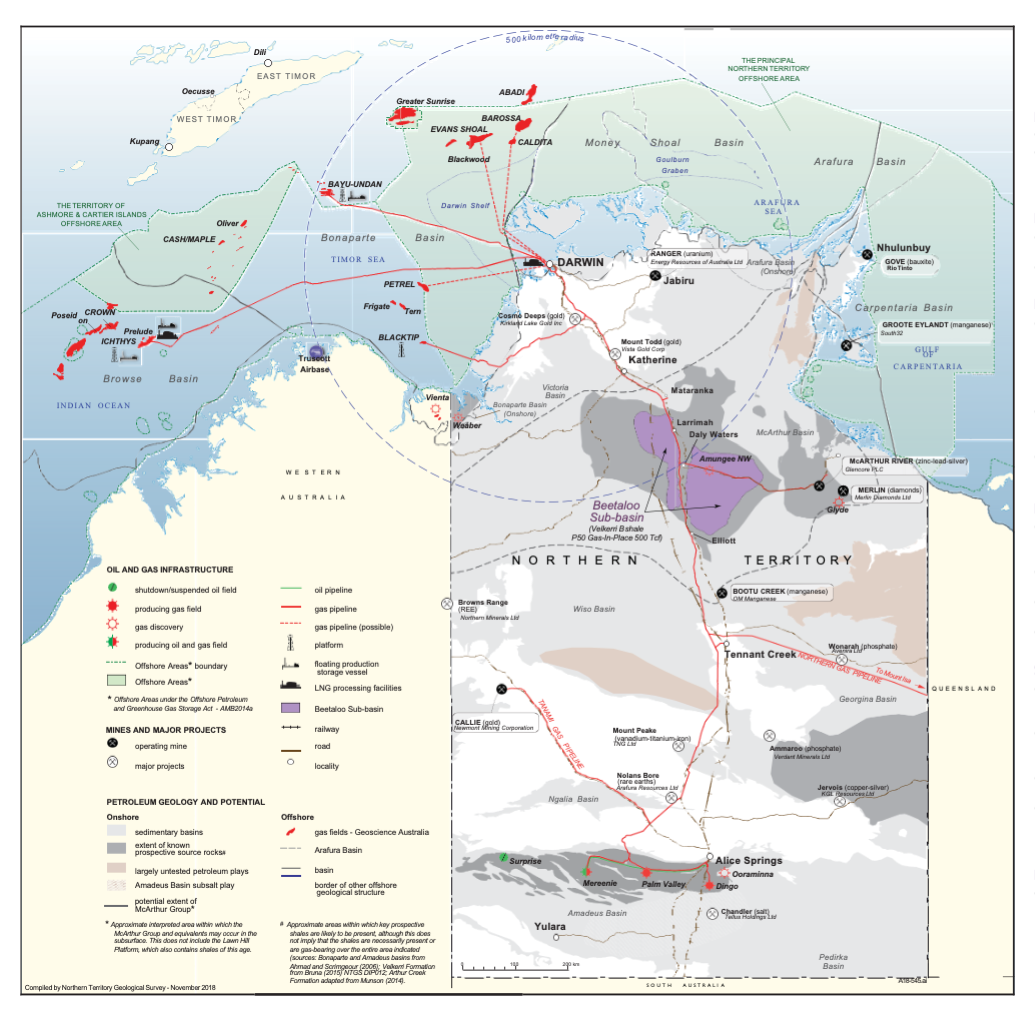

Our onshore and offshore tenements provide unparalleled potential for large unconventional and conventional hydrocarbon accumulations spanning 10 onshore sedimentary basins, many of which are yet to be explored.

Australian Gas and Oil has already entered into one farm-out agreement with Blue Energy Ltd, covering 9 of the permits and applications in the Wiso and Birrindudu Basins.

No further oil and gas acreage is currently available for release by the Northern Territory Government.

Within a supportive investment environment.

- Active exploration by major companies in surrounding Basins, yielding promising outcomes.

- Government royalties are at a low 10% gross.

- Northern Australia is in close proximity to Asia and can play a significant role in supporting exiting and future industrial developments in Asia.

- The Northern Territory has open access to rail, road and a gas pipeline to port.

- Planning for a second pipeline corridor between the Beetaloo sub-Basin and Darwin is underway.

- Planning to develop a local oil and gas-based manufacturing industry in the Northern Territory is well advanced.

Investment Opportunities

- 30 Tcf in undeveloped offshore gas reserves

- Backfill of Darwin LNG facility required by 2023 – two separate joint-ventures, led by ConocoPhillips and Eni, are actively developing projects to backfill Darwin LNG – FID Q1 2020

Expansion of Darwin’s LNG Export Hub

- Gas to expand the LNG hub could be sourced from offshore reserves, onshore gas developments, or both

- Land is secured for five additional trains – one at Darwin LNG and four at Ichthys LNG

- Existing wells drilled by Origin, Santos and Pangaea, and associated discovery reports, indicate a P50 Gas-In-Place Resource of at least 500 Tcf for the Beetaloo Sub-basin in the Velkerri B shale alone. There are further prospective layers in the Beetaloo Sub-basin, and other basins, yet to be assessed

- Proposed 2019 petroleum exploration in the Beetaloo Sub-basin will focus on gas resource definition and testing for liquids rich gas

- Opportunities for water management facilities, civil works and other supporting infrastructure, services and supplies such as proppants

Development of gas-based manufacturing

- Opportunities exist for methane-based products, energy intensive industries, condensate refining and production of ethane-based products

- Early opportunities from offshore gas fields lend themselves to methane-based products

- Future opportunities from onshore gas fields may expand opportunities to include ethane-based petrochemicals

- Land is available for gas-based manufacturing industries near existing LNG facilities

Service and supply for the gas industry

- The NT Government has invested in dedicated infrastructure at the East Arm Logistics Precinct to support offshore projects

- Opportunities to support the offshore gas industry, including the operations of Darwin LNG, Ichthys LNG and Prelude FLNG

- Opportunities to support the onshore industry, particularly shale gas

- The NT Government is partnering with operators and the Industry Capability Network Northern Territory to identify opportunities to grow the service and supply industry

Research, innovation and training

- Opportunities for strategic engagement and partnerships with Charles Darwin University, including through the North Australian Centre for Oil & Gas, the Advanced Manufacturing Alliance and Vocational Education and Training

UNPRECEDENTED ONSHORE OIL & GAS

EXPLORATION PORTFOLIO

NORTHERN TERRITORY, AUSTRALIA

Opportunity for “early mover” to acquire a portfolio of 30 highly prospective oil & gas exploration permits/permit applications covering 70 million acres

Diverse geology: 10 basins including formations analogous to Bakken (Williston Basin)

OVERVIEW & INVESTMENT HIGHLIGHTS

A unique opportunity to acquire a major foothold in Australian onshore oil and gas exploration:

- Unprecedented scale. 30 oil and gas exploration permits/ permit applications covering 70 million acres (285,000 km2)

- Equates to ~3% of Australia and ~20% of Northern Territory

- 10 sedimentary basins = diversified geology = highly prospective. Acreage is well positioned to deliver significant hydrocarbon discoveries reflecting its diversity:

- large potential unconventional and conventional hydrocarbon accumulations

- spans 10 onshore sedimentary basins encompassing varying geological attributes (Proterozoic to Mesozoic sequences, often with stacked section)

- onshore (26 permits/applications) and offshore (4 permit applications)

- Georgina Basin geology is analogous to Bakken formation (Williston Basin)=highly attractive (12.6m acres)

- “Strong technical similarities between Arthur Creek formation and…Bakken Oil Shale.” (Ryder Scott)

- Wiso Basin and deeper sequences (23.8m acres) = 50% farmed-out

- Farm-out agreement covering 9 permits/permit applications (for 50%)

- Early mover advantage

- Frontier acreage – essentially unexplored

- Recent drilling for shale oil & gas in surrounding areas by locals, US companies (Hess, PetroFrontier) and internationals (Statoil, Total, ConocoPhillips, Mitsubishi) + Cooper Basin = shale starting to gain traction in Australia + will enhance the acreage’s value

- Access to existing infrastructure = open access rail, road and gas pipeline to port and refineries for certain tenements

- Supportive investment environment in Northern Territory, Australia

- Low government royalties = 10% gross

- History of major Australian oil & gas discoveries and development (North West Shelf, Bass Strait, Queensland LNG) = attractive for investment

Major oil & gas players in Australia = Chevron, ConocoPhillips, Exxon, Shell, BG (British Gas), Mitsubishi - Proximity to Asia: Northern Australia set to play an increasing role in the unfolding Asian Century

- No further oil & gas acreage (of any size) available to be released by Northern Territory government

Basin Summary

| Basin at surface | Wiso | Georgina | Canning |

| Acres | 23.8 million | 12.6 million | 2.3 million |

| Onshore/Offshore | All Onshore | All Onshore | Onshore |

| Deeper Sequences | √ | ||

| Epoch | Devonian to Proterozoic | Devonian to Neoproterozoic | Cretaceous to Ordovician |

| Exploration Permits (EP)/Applications(EPA) | 2 EPs + 6 EPAs (farm-outagreementwith Blue Energy for 50%) | 1 EP + 5 EPAs | 1 EPA |

| EP Numbers | 205, 207 | 222 | – |

| EPANumbers | 199,206,208,209,210,211 | 201,202,203,204,221 | 228 |

| Other companies in Basin | Statoil, Petrofrontier, Total, Central Petroleum Ltd, Armour Energy Ltd | Mitsubishi/Buru Energy; Conoco Phillips/New Standard Energy | |

| Recent Drilling Activity | Statoil/Petrofrontier JV: 304 km 2D seismic in 2013, 5 vertical wells in 2014; part of $60m program |

| Basin at surface | Arafura | Bonaparte | Birrindudu |

| Acres | 2.9 million | 3.1 million | 3.8 million |

| Onshore/Offshore | Onshore | Onshore | Onshore |

| Deeper Sequences | √ | ||

| Epoch | Carboniferous to Neoproterozoic | Cenozoic to Cambrian | Mesoproterozoic to Palaeoproterozoic |

| EP/EPA | 1 EPA | 1 EPA | 1 EP |

| EP Numbers | – | – | 200 (part of farm-out with Blue Energy) |

| EPA Numbers | 212 | 175 | – |

| Other companies in Basin | Beach energy, Advent Energy (gas discoveries in WA part of basin) | ||

| Recent Drilling Activity | Beach drilled 2 wells in 2014, intersecting a gas column |

| Basin at surface | Daly | Eromanga | McArthur | Money Shoal |

| Acres | 6.5 million | 1.9 million | 3.9 million | 9.6 million |

| Onshore/Offshore | Onshore | Onshore | Onshore | Onshore & Offshore |

| Deeper Sequences | √ | √ | ||

| Epoch | Ordovician to Proterozoic | Cretaceous to Jurassic | Mesoproterozoic to Palaeoproterozoic | Eocene to Proterozoic |

| EP/EPA | 3 EPAs | 2 EPAs | 1 EPA | 6 EPAs (2 onshore; 4 offshore) |

| EP Numbers | – | – | – | – |

| EPA Numbers | 218, 219, 220 | 225, 226 | 217 |

214, 215, 216, 223, 224, NTC/P11 |

| Other companies in Basin | Santos, Tamboran Resources, Armour Energy, Origin Energy, Sasol |

EXPLORATION PERMITS AND PERMIT APPLICATIONS

AUSTRALIAN OIL AND GAS PTY LTD

LAND TENURE

1.Aboriginal (indigenous) freehold land = ~50%

- Granted under Aboriginal Land Rights (Northern Territory) Act 1976 (Cth) to a Land Trust associated with a Land Council.

- Land Trust can only grant Exploration Permits (EP) at Land Council’s direction (following process of consultation with and consent of traditional owners).

- Consultation process underway with relevant Land Councils (Northern Land Council and Central Land Council) for respective Exploration Permit Applications (EPA).

2.Crown land (managed by NT Department of Lands, Planning and the Environment) under pastoral lease = ~50%

- Some acreage is subject to Native Title Act 1993 (Cth) (recognises some indigenous rights and interests to land).

- Native title claimants and holders (usually represented by Land Councils) have procedural rights around EPAs (‘right to negotiate’ procedure + agreement re terms & conditions of EP grant – but subject to arbitration).

INVESTING IN THE NORTHERN TERRITORY

- The Northern Territory boasts abundant natural resources, a dynamic mining and energy industry (including an international gas hub), major construction and infrastructure projects and a competitive tax environment.

- BHP Billiton, Rio Tinto and Xstrata operate major mines in NT.

- Natural gas and petroleum exports form an important and growing sector of the local economy.

- Construction of onshore processing facilities for the $34bn Ichthys LNG Project (Inpex operated) is underway.

- Darwin is the closest Australian capital city to Asia

| Australia | Northern Territory | |

| Population |

23.13 million (4.58m in Sydney) |

245,079 |

| Capital City | Canberra | Darwin |

| Other Major Cities/Towns | Sydney, Melbourne, Brisbane, Perth | Alice Springs (near Ayers Rock); Tennant Creek |

| Credit Rating | AAA | Aa1 |

| A$/US$ | $0.77 | $ 0.77 |

| Government | Federal government (Liberal Party) + 5 state + 2 territory governments |

Northern Territory government (Country Liberal Party) |

| Airport | Largest = Sydney International Airport | Darwin – International Airport |

| Climate | Varies by state |

· “Wet season”: October – April = high humidity, heavy monsoonal rainfall · “Dry season”: May – Sept |

OPPORTUNITY

Australian Gas & Oil Pty Ltd (AGO), through its wholly owned subsidiaries, holds a 100% interest in 30 oil and gas EP/EPAs. AGO has entered into one farm-out agreement pertaining to the 9 EP/EPAs in the Wiso & Birrindudu Basins under which a 50% interest will be transferred to Blue Energy Ltd upon completion of agreed exploration program.